What is the journal entry to record a foreign exchange transaction

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

Foreign currency transactions and financial instruments

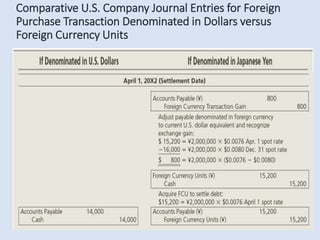

Accounting Journal Entries for Foreign Exchange Gains and Losses

Currency Exchange Gain/Losses

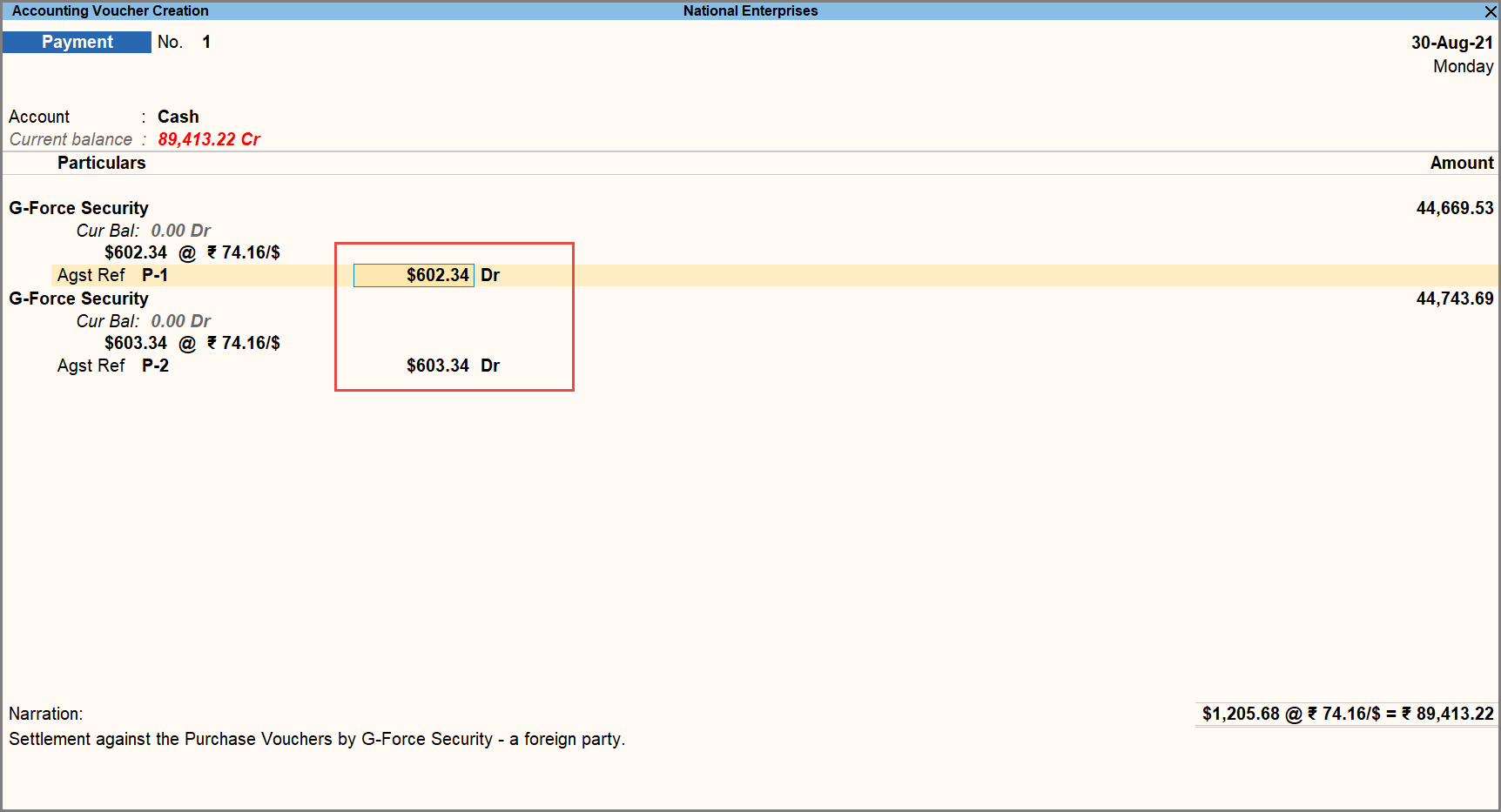

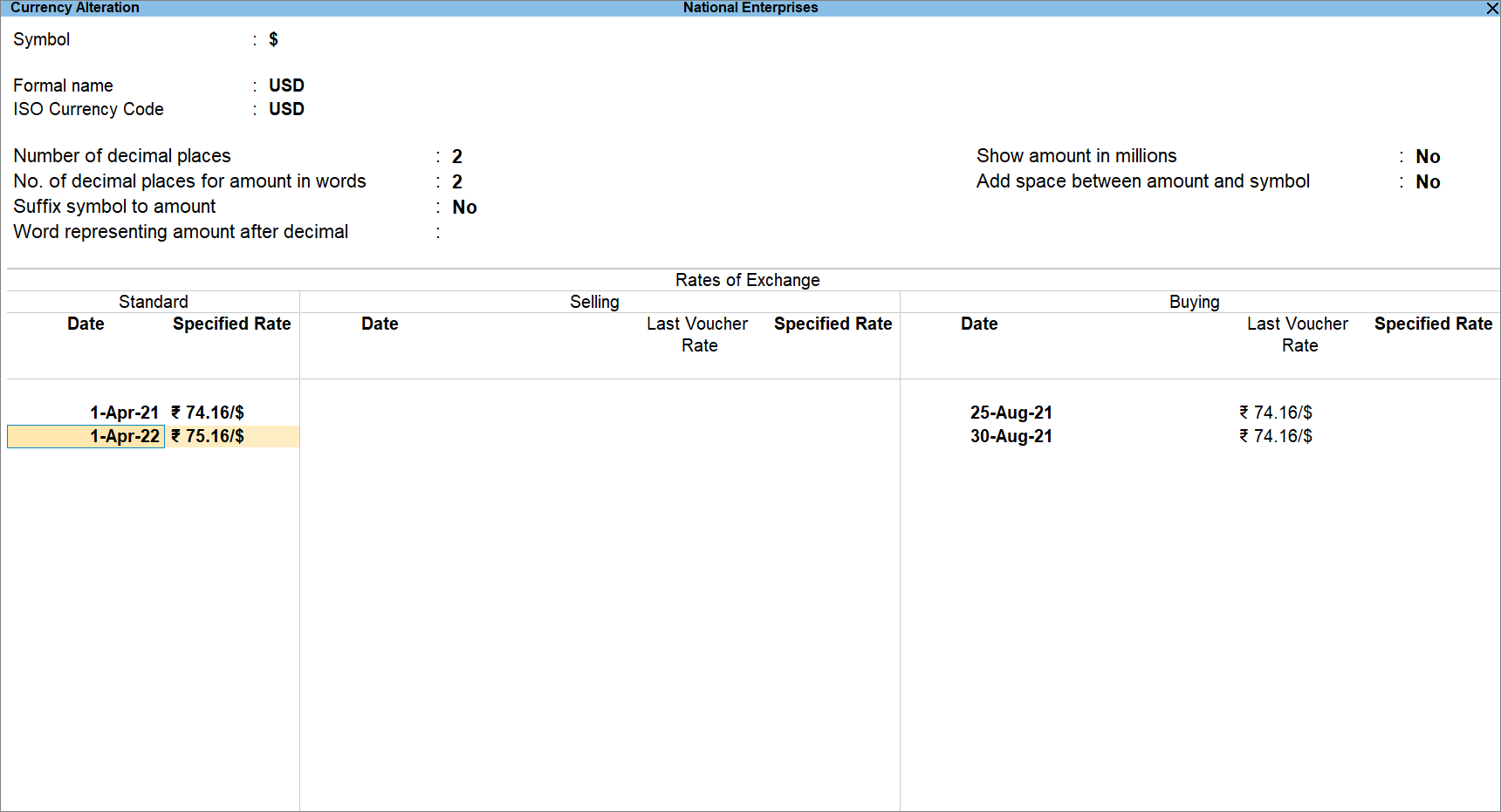

Currency in TallyPrime - FAQ

SOLVED: Journal entries for an account receivable denominated in Euros (USD weakens). Assume that your company sells products to a customer located in France on October 15. The invoice specifies that payment

Module 7: Foreign Currency Transaction and Hedge Accounting: - PDF Free Download

Record exchange rates at payments — Odoo saas-15.1 documentation

SOLUTION: Important Questions on Foreign exchange and Hire purchase - Studypool

Foreign currency transactions and financial instruments

Currency in TallyPrime - FAQ

Currency Translation Adjustments

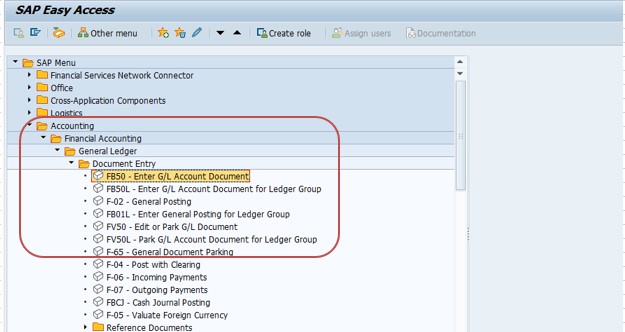

Entering and Processing Foreign Currency Journal Entries