:max_bytes(150000):strip_icc()/Paperwork-e37c702a00d14be19f976222e20edb5f.jpeg)

Can Moving into a Higher Tax Bracket Cause Me to Have a Lower Net Income?

4.5

(768)

Write Review

More

$ 13.99

In stock

Description

Making more money and moving into a higher marginal tax bracket will not lower your take-home or net pay.

Canada Taxes 2023: Federal Tax Brackets, Rates and Credits

:max_bytes(150000):strip_icc()/tax_avoidance.asp-Final-9d7e3d82dc5c4ce293256ff9d548494d.png)

What Is Tax Avoidance and How Is It Different From Tax Evasion?

:max_bytes(150000):strip_icc()/tax_refund-7f8e7a5064a0411381a554001e842085.jpg)

What Is a Tax Refund? Definition and When to Expect It

How are capital gains taxed?

State Estate Tax Rates & State Inheritance Tax Rates

2020 Federal Income Tax Rates Catalog Sale

Virginia's highest tax bracket starts at $17K. Some say it's time for an update. • Virginia Mercury

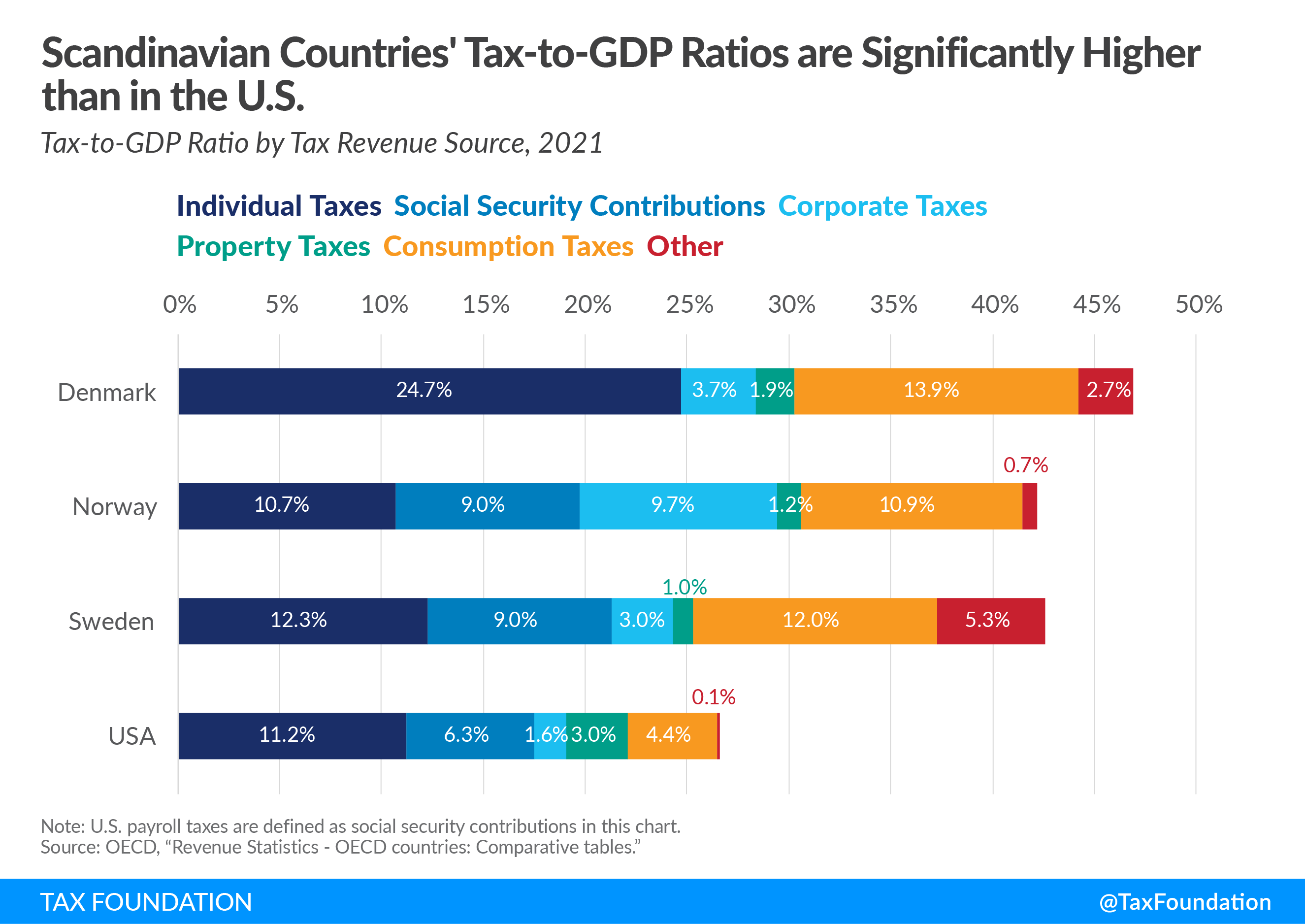

How Scandinavian Countries Fund Social Programs

Can Capital Gains Push Me Into a Higher Tax Bracket? — Quarry Hill Advisors

Negative income tax - Wikipedia

Thomas J Rapak CPA (@TJR_CPA) / X

Capital Gains Tax Brackets For 2024

Related products

You may also like