ATIR rules on taxability of split contract arrangements under Pakistan-China Double Tax Treaty

Recently, Pakistan’s Appellate Tribunal Inland Revenue (ATIR second tier appeal forum) has allowed an appeal against the tax authority’s order for recovery of withholding tax

Trade in Services Between India and Pakistan

China–Pakistan Economic Corridor - Wikipedia

2001 - Ministry of Law and Justice

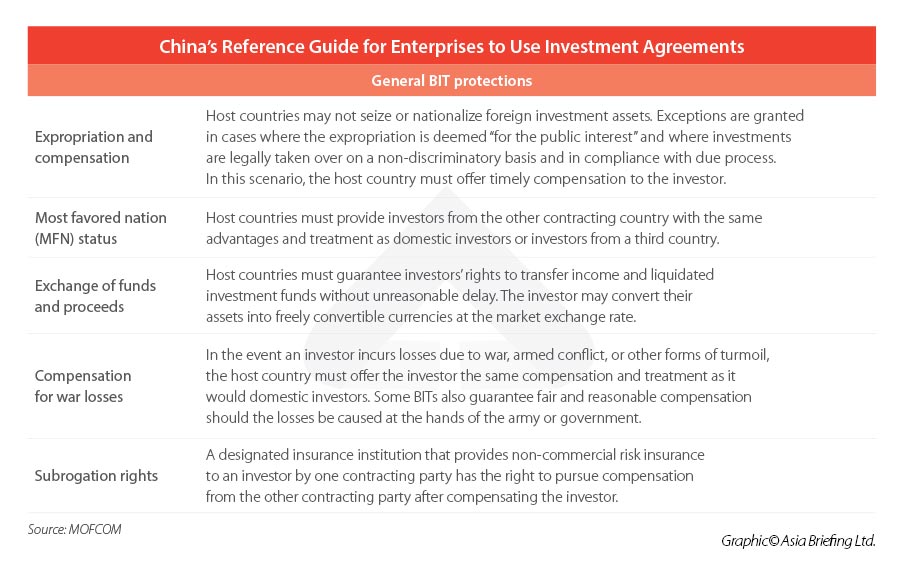

China BITs: How to Use Bilateral Investment Treaties

A step towards new market jurisdiction taxation rights

ITP Newsletter

Document

H1 2021: Top 100 most-read ITR Expert Analysis articles

Chapter 14 Formulary Apportionment in Theory and Practice in

UAE VAT Law - Draft Executive Regulation

Chapter 2. Modernizing the Tax Policy Regime in: Modernizing China

BCAS - DTAA Study Course - Presentation on Article 8 on International Shipping - 01.12.2012

Countries with Double Taxation Treaties with Pakistan