How to calculate carry and roll-down (for a bond future's asset

4.9

(667)

Write Review

More

$ 8.99

In stock

Description

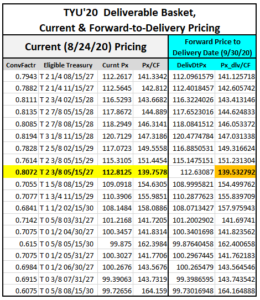

fixed income - Determine the carry of a treasury bond futures

Returns Attribution Analysis

CTA Simplify Managed Futures Strategy ETF

Carry and Roll-Down of USD Interest Rate Swaps in Excel with

Fixed income: Carry roll down (FRM T4-31)

Carry and Roll-Down of USD Interest Rate Swaps in Excel with

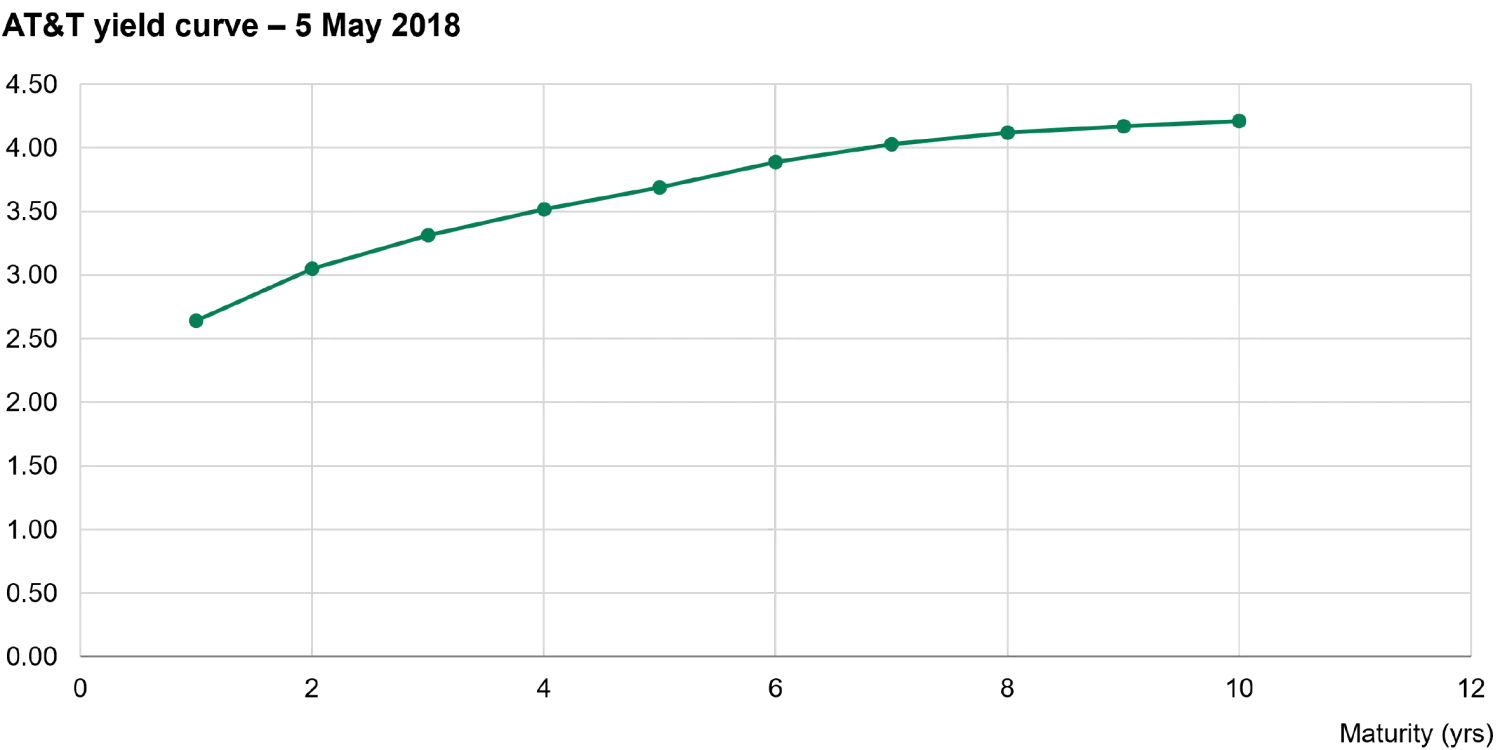

Fixed Income 101: Roll-down

Contango - Wikipedia

How to calculate carry and roll-down (for a bond future's asset

Carry and Roll-Down of USD Interest Rate Swaps in Excel with

Understanding Treasury Futures Roll Spreads

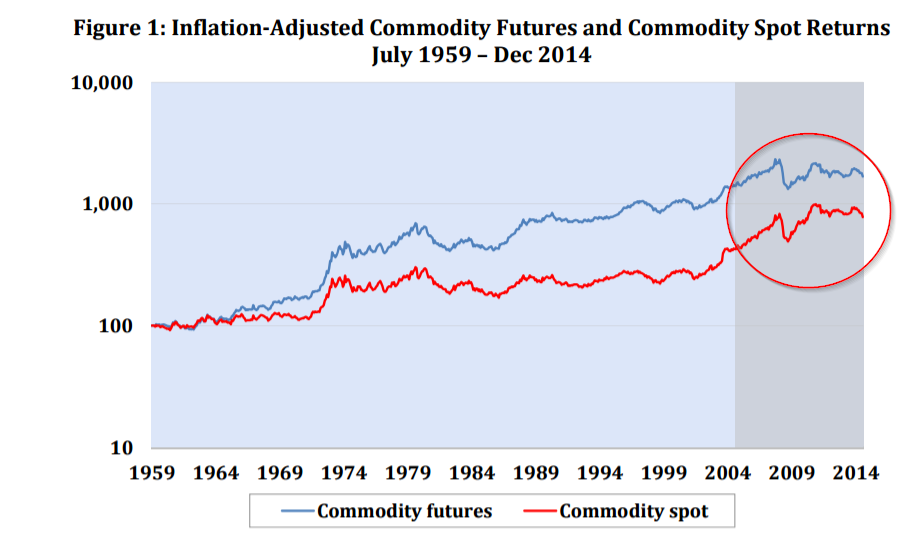

Commodity carry as a trading signal – part 1

Commodity Futures Investing: complex, volatile, and fascinating

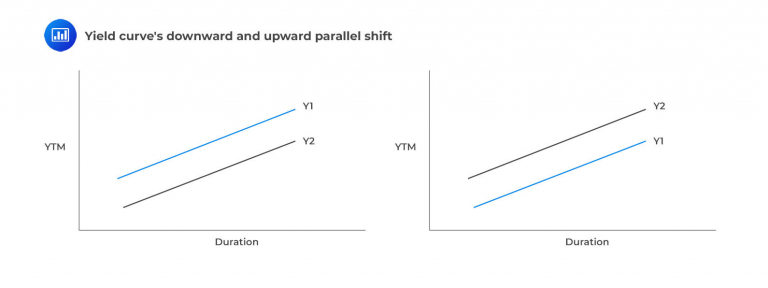

Yield Curve Strategies - CFA, FRM, and Actuarial Exams Study Notes

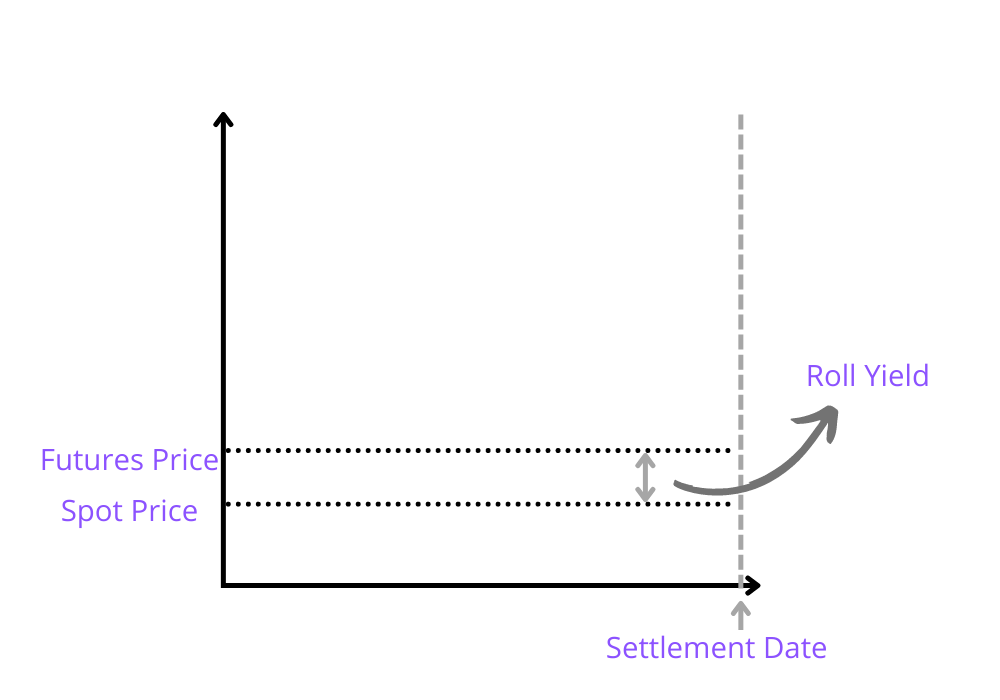

Roll Yield - Overview, How It Works, How To Calculate

Related products

You may also like