Who is a 'Person' under S. 2(31) of Income Tax Act in India

Find out what constitutes a 'person' under Section 2(31) of the Income Tax Act in India and what it means for tax purposes.

Income tax in India - Wikipedia

ITR Filing Last Date FY 2023-24: ITR-1,4 for income tax return filing FY2023-24 notified by CBDT; last date to file July 31, 2024 - The Economic Times

What is Section 40A(2) of income tax: Eligibility, Expenditures, Deductions & How to Calculate

IMPORTANT DEFINITIONS INTHE INCOME-TAX ACT, ppt video online download

How to keep more of your retirement income and pay less tax

Kabir & Associates

Definitions in Income Tax Act 1961 with MCQs - Deep Gyan®

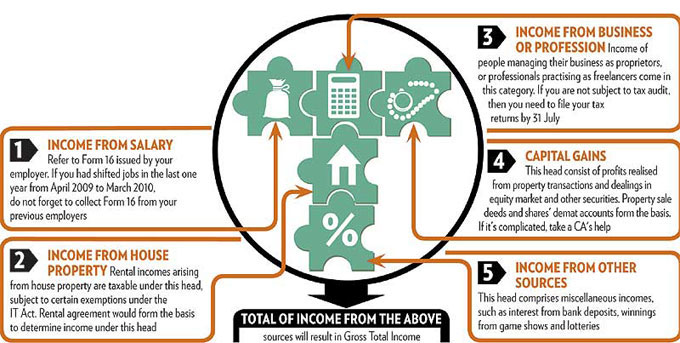

5 heads of income in the Indian Income Tax Act

:max_bytes(150000):strip_icc()/standarddeduction-resized-8f2ac3f88bca4ef099d637cb80f79e29.jpg)

Standard Deduction in Taxes and How It's Calculated

Dr.S.S.Jadhav Head, Dept of Commerce mrs.k.s.k. college beed - ppt download

SOLUTION: Introduction of residential status for set of tax - Studypool

ITR U - What is ITR-U & How to File Updated Return (ITR-U) - Tax2win