Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

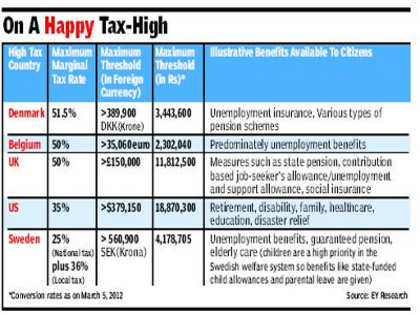

Can income tax be abolished? What are the pros and cons of abolishing income tax? - The Economic Times

The Pros and Cons of Payroll Taxes - CPA Practice Advisor

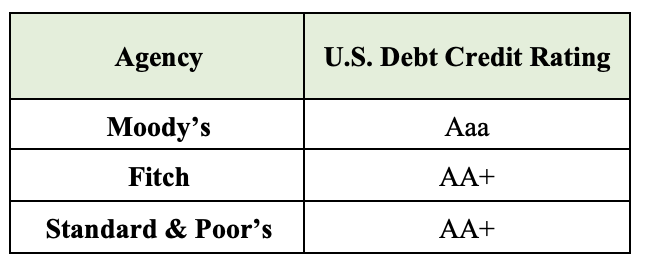

The Fitch Downgrade – The Quixotic DeaconThe Quixotic Deacon

7 Ways to Pay Less Taxes on Social Security Benefits

Social Security: Which Americans Would Be Most Affected by a Tax Cap?

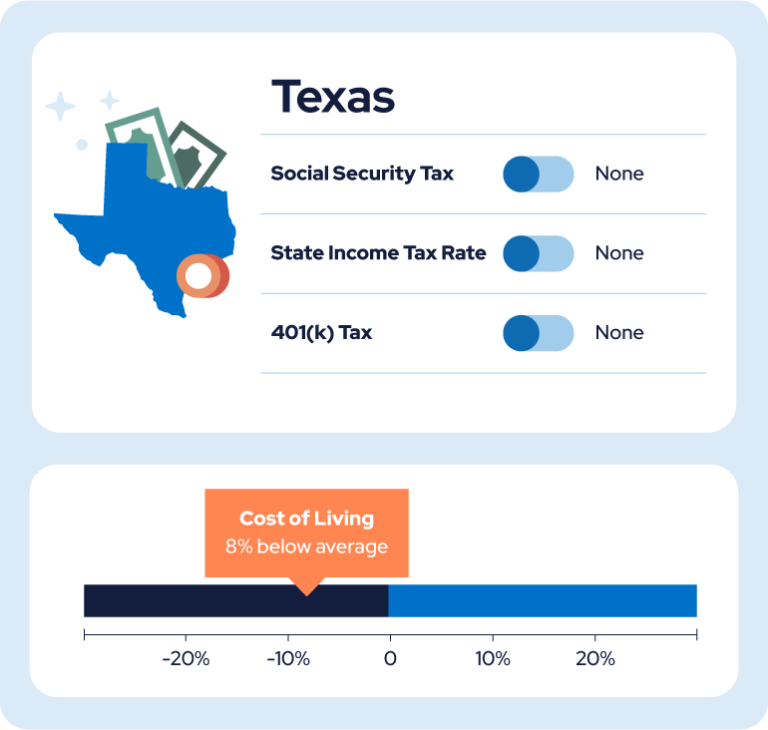

States That Don't Tax Social Security [+ Retiree-Friendly States]

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)

Should We Eliminate the Social Security Tax Cap? Here Are the Pros

The Peter G. Peterson Foundation on LinkedIn: Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

:max_bytes(150000):strip_icc()/fica.asp_FINAL-428c1827d08648be803aea413ebacd15.png)

Why Is There a Cap on the FICA Tax?

Distributional Effects of Raising the Social Security Taxable Maximum

Should You Buy a Deferred Annuity? Pros & Cons

Overview of FICA Tax- Medicare & Social Security, fica tax

The Peter G. Peterson Foundation on LinkedIn: #socialsecurity