:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

What Is Social Security Tax? Definition, Exemptions, and Example

The Social Security tax, levied on both employers and employees, funds Social Security and is collected in the form of a payroll tax or a self-employment tax.

What is the FICA Tax and How Does it Connect to Social Security

What Is Social Security Tax? Definition, Exemptions, and Example

:max_bytes(150000):strip_icc()/GettyImages-1092362376-1f86aba4cb364113abd06b9a1eaca4bb.jpg)

Avoid the Social Security Tax Trap

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com, fica

What Is Social Security Tax? Definition, Exemptions, and Example

What Is And How To Calculate FICA Taxes Explained, Social Security

:max_bytes(150000):strip_icc()/TermDefinition_Formw2.asp-c3449a39050e489489437053f874f533.jpg)

Payroll Deduction Plan: Definition, How It Works, and Reasons

:max_bytes(150000):strip_icc()/GettyImages-1032614258-2718b152dba04758aef5818875fee449.jpg)

When Do I Stop Paying Social Security Tax?

Requesting FICA Tax Refunds For W2 Employees With Multiple

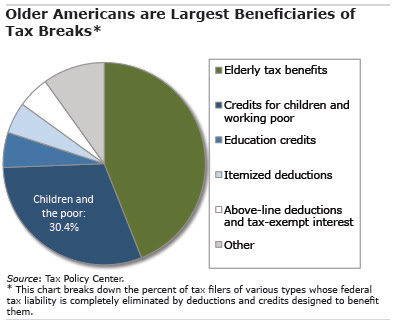

UAE Corporate Tax Registration Exemptions – Tax, 46% OFF

:max_bytes(150000):strip_icc()/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg)

Federal Insurance Contributions Act (FICA): What It Is, Who Pays

What Eliminating FICA Tax Means for Your Retirement, fica tax