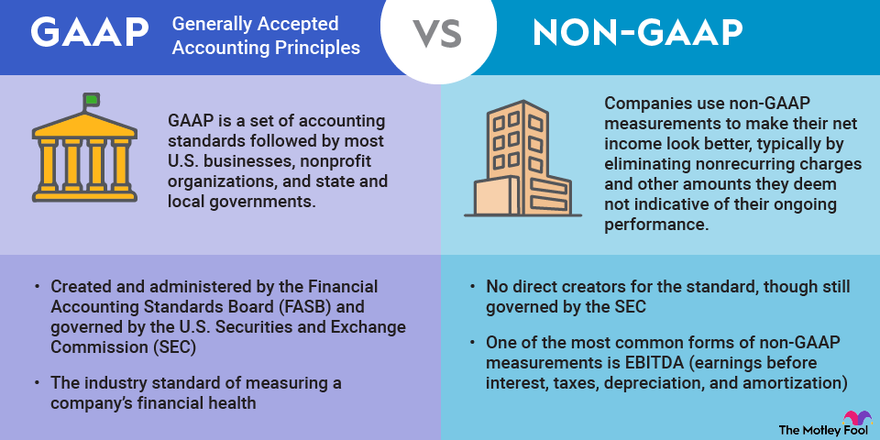

Qualified Vs Non-Qualified ESPPs

Qualified vs Non-qualified ESPPs. We take you through an explanation of what they are, their differences and which one is best for you as an employee.

This post explains the two main types of employee stock purchase plans (ESPPs), detailing the differences between them and their tax implications.

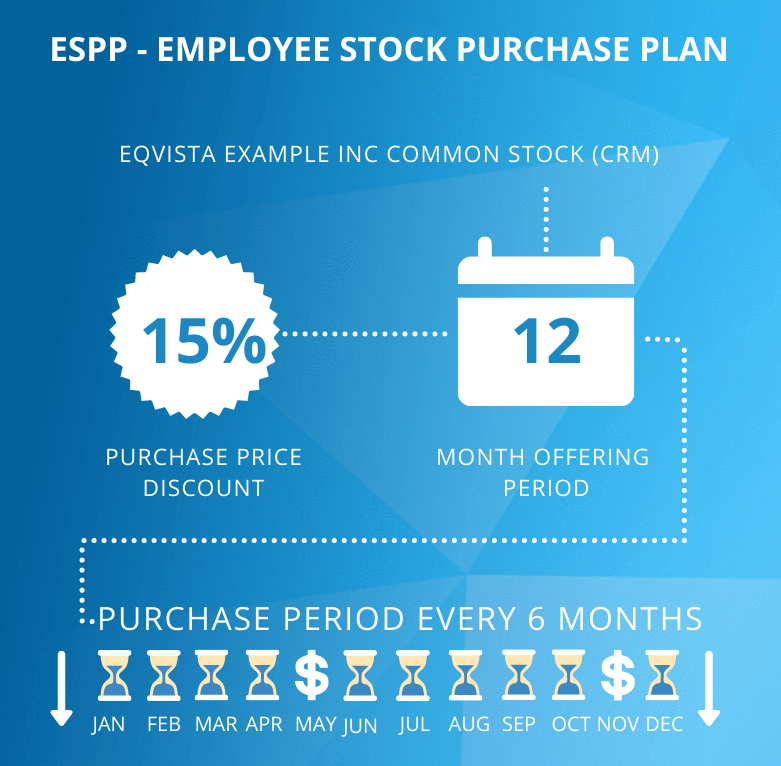

ESPP or Employee Stock Purchase Plan

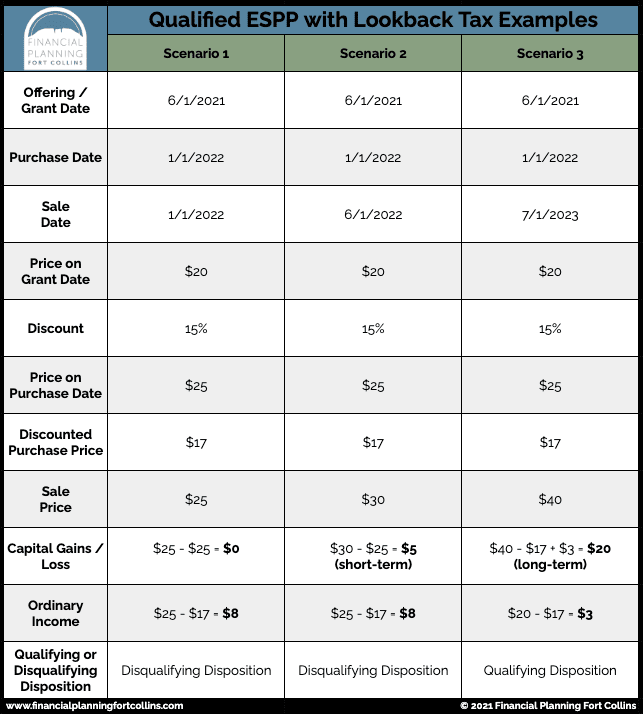

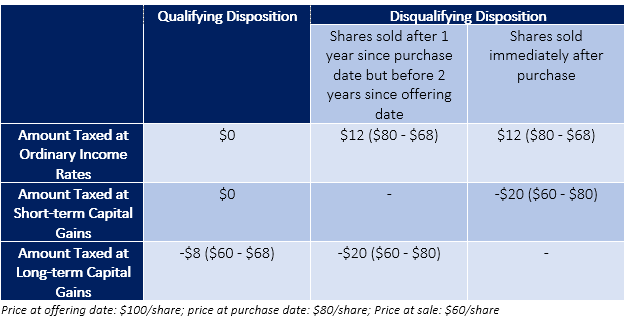

Qualified vs. Non-Qualified ESPP: Tax Benefits and Risks

Qualified Plans - FasterCapital

Much Company Stock - FasterCapital

All About ESPPs - Financial Planning Fort Collins

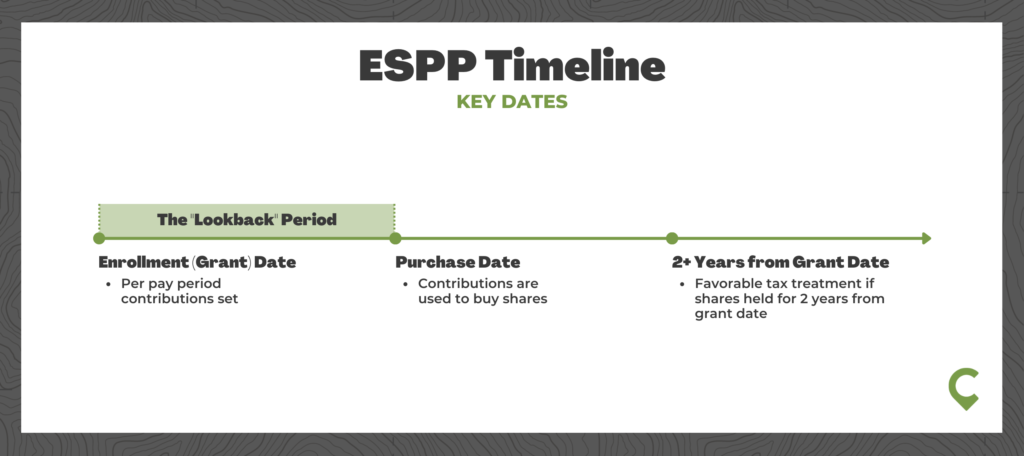

Timing is Everything: The Importance of ESPP Stock Purchase Dates - FasterCapital

All About ESPPs - Financial Planning Fort Collins

ESPP: The Five Things You Need to Know

espp discounts - FasterCapital

How You Can Benefit from a Down Market Using an Employer Stock Purchase Plan

Stock Purchase - FasterCapital

Espp Stock Purchase Dates - FasterCapital

.jpeg)