Andorra Tax Rates: a Complete Overview of the Andorra Taxation for

Andorra offers favourable taxation regimes for individuals and companies. The income tax applies only to the annual amount exceeding €24,000. The corporate tax rate is 10%, and the VAT is 4.5%. Learn more about the effective rates, exemptions and how to become a tax resident of Andorra.

Guide to the French tax system and how to pay income tax

a.storyblok.com/f/176292/1536x864/484ef9f9d4/andor

Andorra Tax Rates: a Complete Overview of the Andorra Taxation for Individuals and Businesses

Living in Andorra: A Resident's Guide to Moving

No Tax Countries: Tax-Free Countries in 2024

Taxation in Andorra Jurisprudential LTD

/_next/image/?url=https%3A%2F%2

Andorra Tax Rates: a Complete Overview of the Andorra Taxation for Individuals and Businesses

Unique appeal of Andorra: a microstate that is on the rise

The Tax System of Andorra

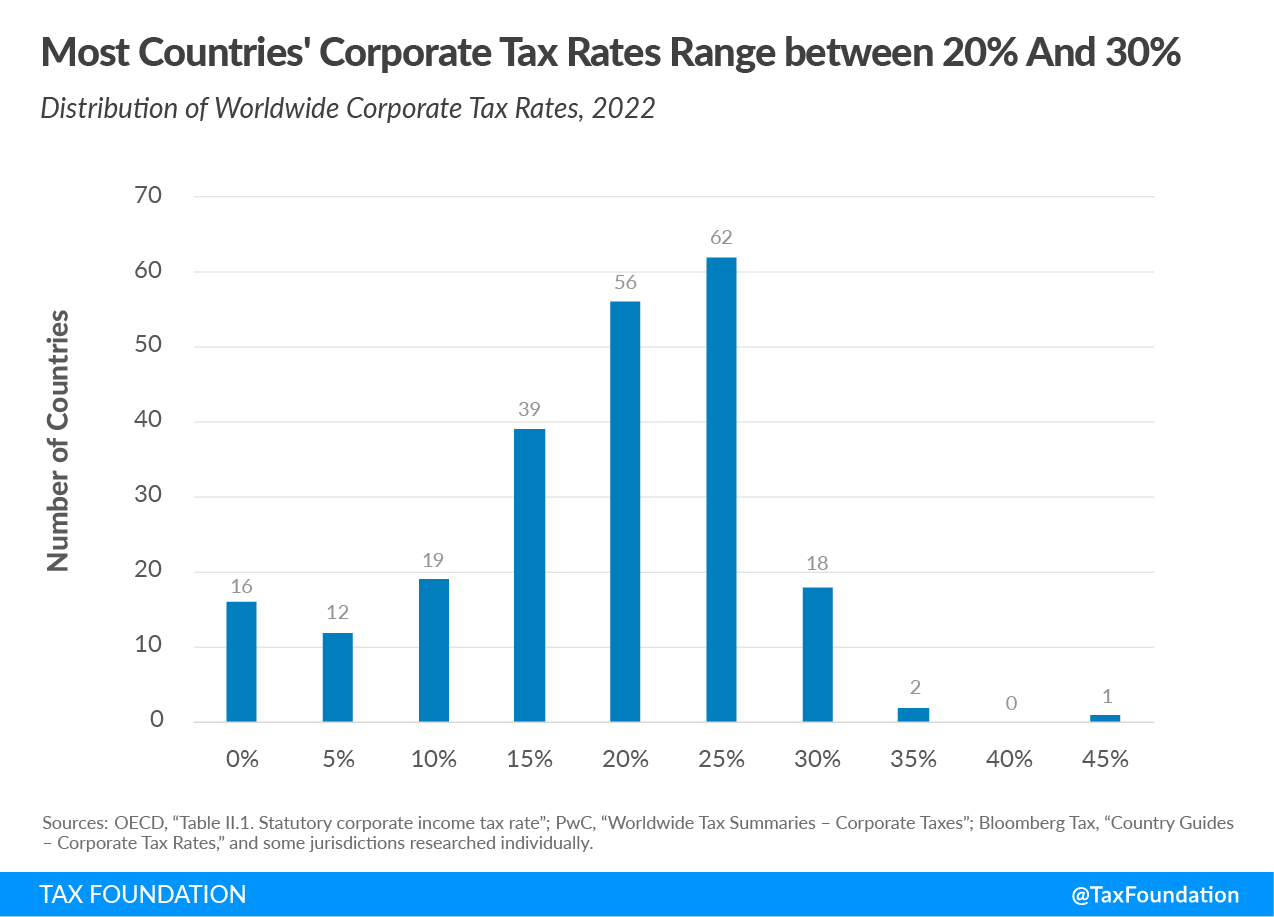

Corporate Tax Rates by Country, Corporate Tax Trends

Andorra Sales Tax Rate - VAT

The True Cost of Living in Andorra

Taxes in Andorra: how to get a residence permit and become a tax resident

TAX RATES AND GEOGRAPHICAL SIZE OF COUNTRIES IN 1996