Non-Profit Organizations, Ohio Law, and the Internal Revenue Code

The relationship and interaction between Ohio law governing not-for-profit organizations and the Internal Revenue Code provisions governing tax-exempt and charitable organizations can be confusing and often misunderstood. Many people assume that one necessarily means the other, which is not the case.

Nonprofit Bylaws: Complete Guide With Tips & Best Practices

Income - General Information

Sales taxes in the United States - Wikipedia

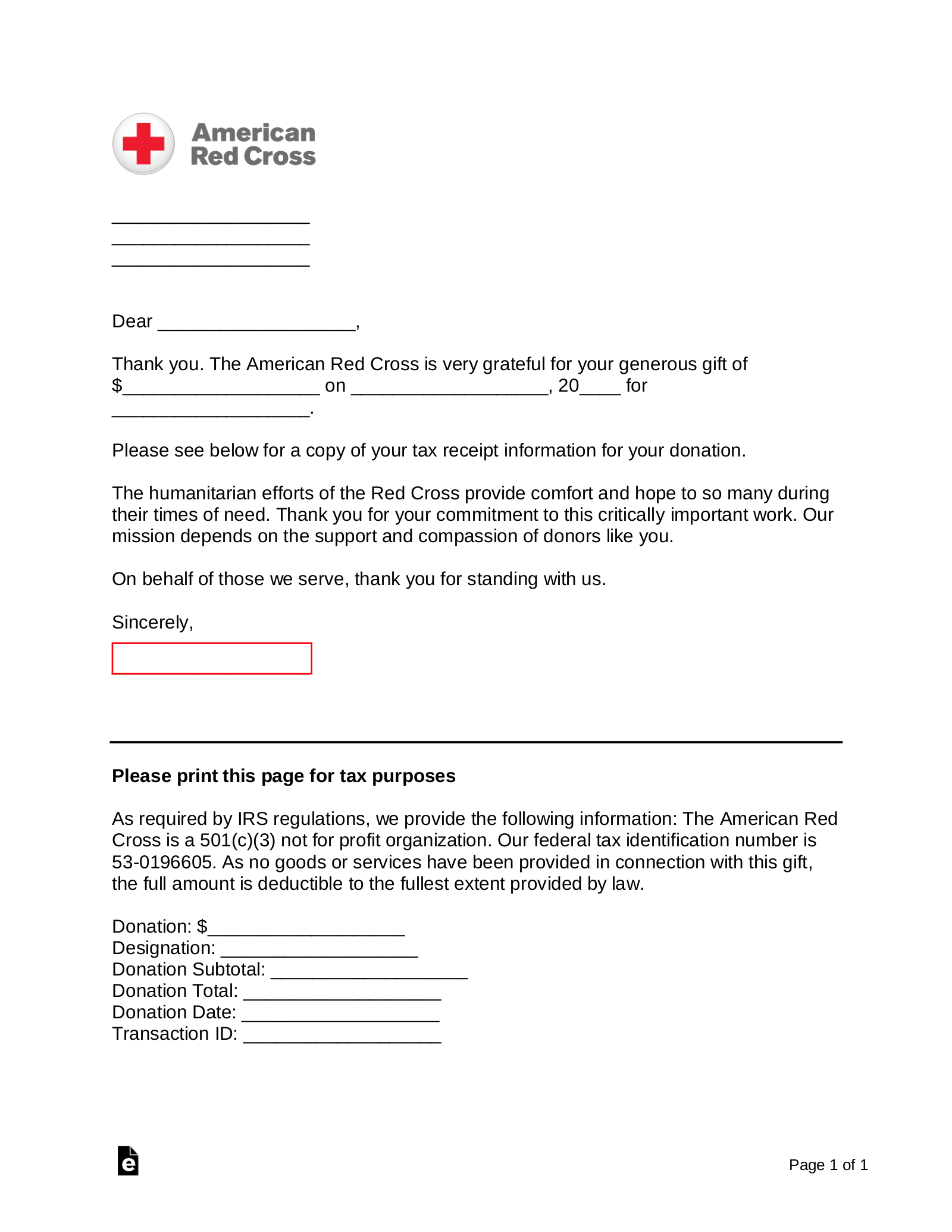

Free American Red Cross Donation Receipt Template - PDF

Charitable Bingo - CHARITABLE OHIO

Nonprofit Board of Directors, Officers & Members Explained

Free Cash Donation Receipt - PDF

Nonprofit Governance by State, Harbor Compliance

Does a Church Need 501(c)(3) Status? A Guide to IRS Rules - Foundation Group®

Most Common Lawsuits for Nonprofits - Emplicity PEO & HR Outsourcing

THE Foundation #1 NIL for Ohio State

Soft money group raises $1 million to advance Frank LaRose's Ohio U.S. Senate bid • Ohio Capital Journal

Free Donation Receipt Template, 501(c)(3) - PDF

Non-Profit Organizations, Ohio Law, and the Internal Revenue Code