:max_bytes(150000):strip_icc()/graham-number.asp-final-ce508e6a898b4d2394792c6ac3708705.png)

Graham Number: Definition, Formula, Example, and Limitations

The Graham number is the upper bound of the price range that a defensive investor should pay for a stock.

Net Current Asset Value: Graham's Formula Explained

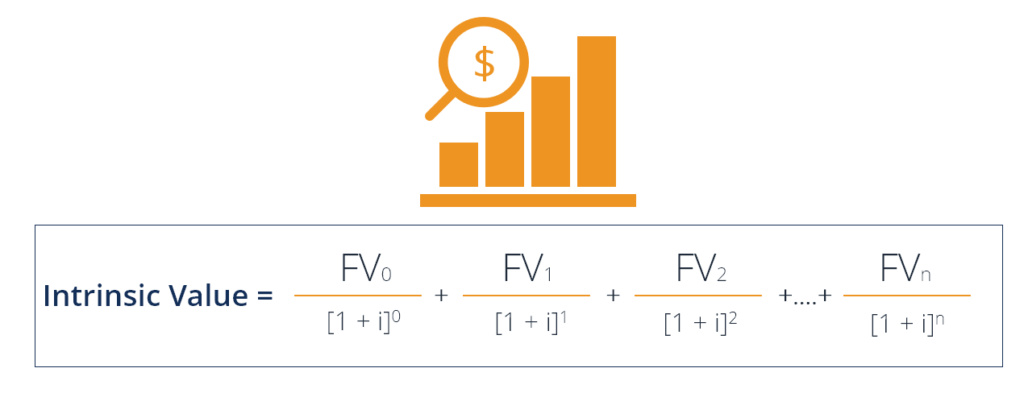

Intrinsic Value - Learn How to Calculate Intrinsic Value of a Business

Book Value Per Common Share (BVPS): Definition and Calculation

Graham Formula: Taking a Look at the Way Benjamin Graham Values Stocks

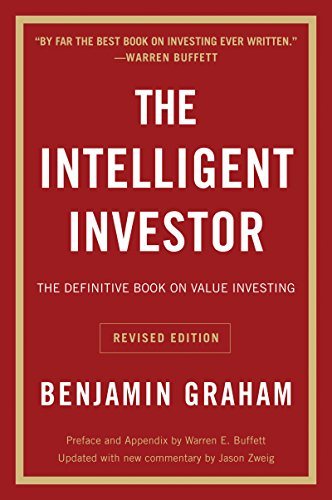

The Intelligent Investor by Benjamin Graham • Novel Investor

How To Use The Graham Number

Benjamin Graham Formula & Stock Valuation

What is Benjamin Graham's formula to find a fair price for an

Benjamin Graham's Instagram, Twitter & Facebook on IDCrawl

:max_bytes(150000):strip_icc()/GettyImages-865226698-2fef1d5dae1944839ece7a3cd81902ac.jpg)

Does a High Price-to-Book Ratio Correlate to ROE?

Intrinsic Value - Learn How to Calculate Intrinsic Value of a Business

:max_bytes(150000):strip_icc()/bengraham.asp-ADD-V1-85a6ac15b8bd4be7af14e7037f1c2443.jpg)

Benjamin Method: Meaning, Formula, Example

Graduate student to release book sharing experiences of life as a

Dynamic Viscosity Formula - GeeksforGeeks