Millennial Money: Navigating the SSI 'marriage penalty', National

For people who rely on Supplemental Security Income, or SSI, getting married can result in reduced monthly benefits and a lower amount allowed for savings. Individual SSI recipients can own up to $2,000 in resources, while couples can have a combined $3,000. Though these limits can dissuade some couples from marrying, exemptions for assets such as primary residences and wedding rings can help bypass these kinds of restrictions. Social Security programs such as Plan to Achieve Self-Support and Achieving a Better Life Experience also offer flexible savings avenues.

Millennial Money: Navigating the SSI 'marriage penalty' - The San Diego Union-Tribune

How Tom Suozzi's Big Win Upended Washington's Border Wars

Millennial Money: Navigating the SSI 'marriage penalty

All the tax changes coming in April 2024

The Mecklenburg Times, March 26, 2024 by SC Biz News - Issuu

U.S. pediatricians back gay marriage, cite research - The Columbian

Millennial Money: Navigating the SSI 'marriage penalty' - The Washington Post

Millennial Money: Navigating the SSI 'marriage penalty

Navigating the SSI 'Marriage Penalty', National

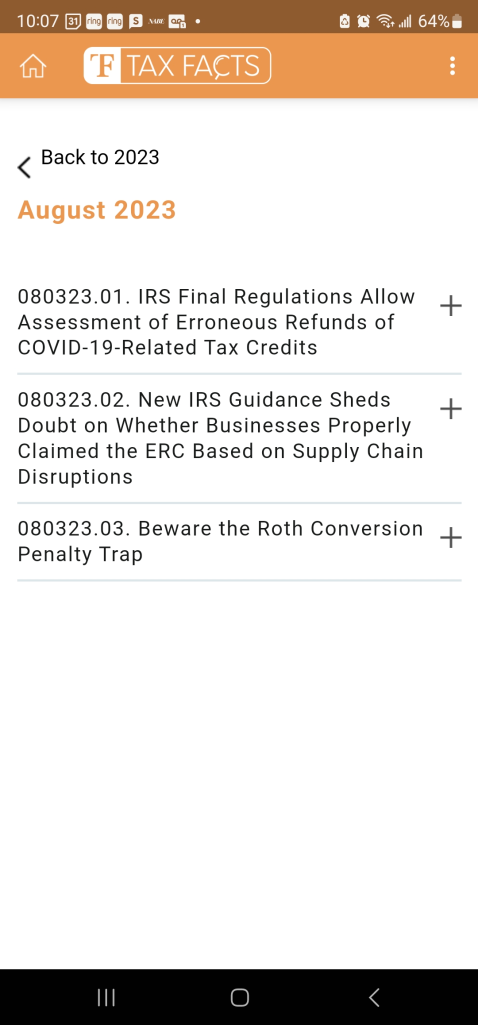

William Byrnes' Tax, Wealth, and Risk Intelligence