Low-Income Housing Tax Credit Could Do More to Expand Opportunity for Poor Families

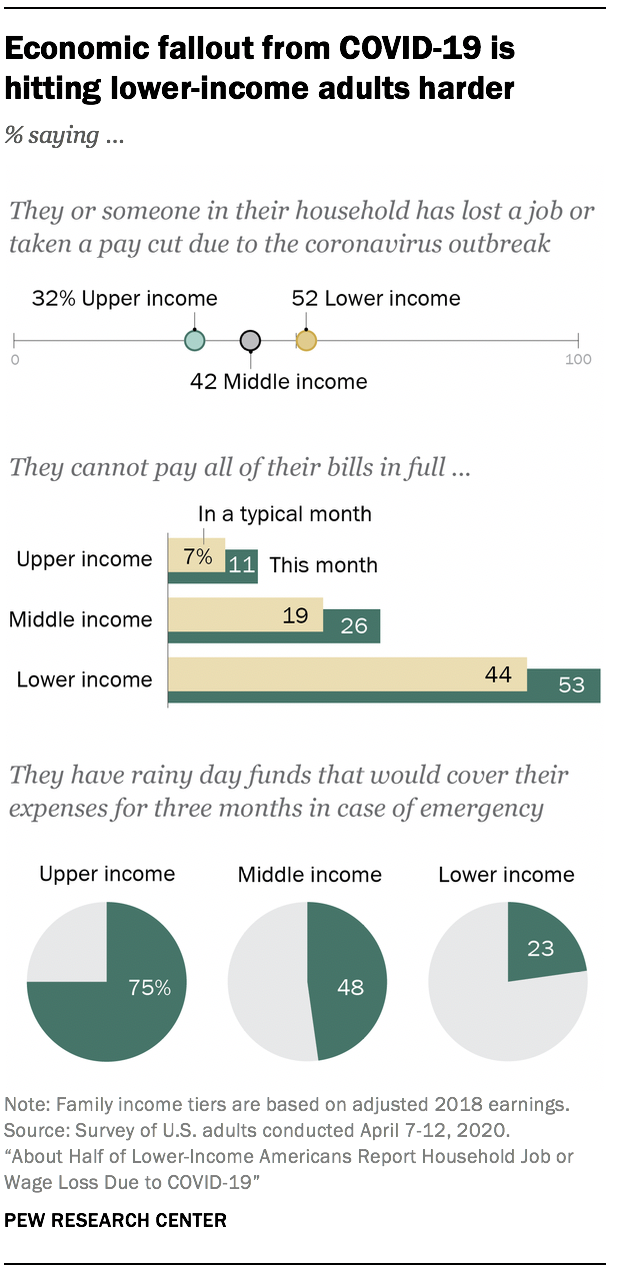

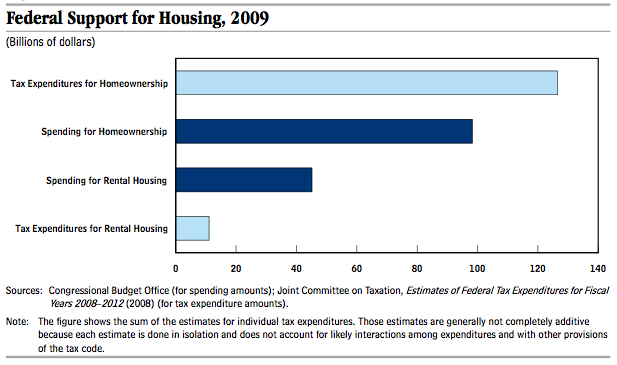

As the nation’s largest affordable housing development program, the Low-Income Housing Tax Credit has substantial influence on where low-income families are able to live.

LIHTC Provides Much-Needed Affordable Housing, But Not Enough to Address Today's Market Demands

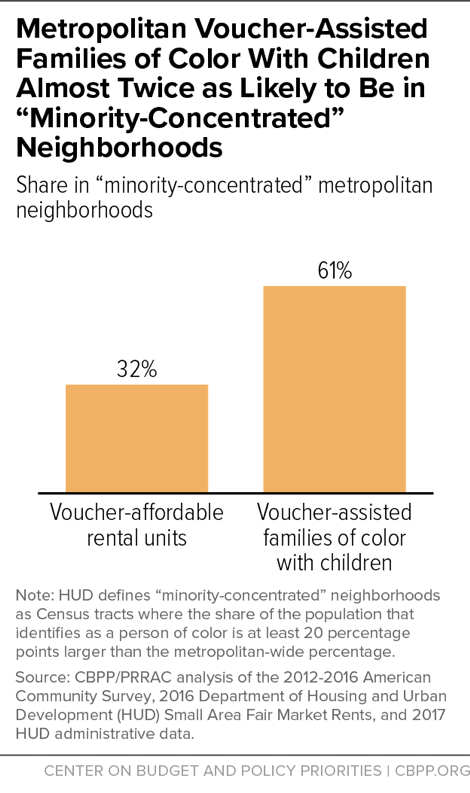

Where Families With Children Use Housing Vouchers

Bipartisan deal to expand child tax credit, revive business tax

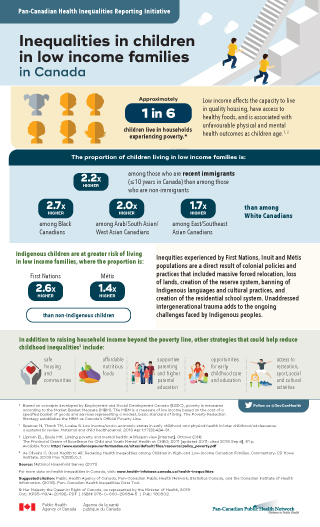

States are Boosting Economic Security with Child Tax Credits in

Congress May Expand The Low-Income Housing Tax Credit. But Why?

Child tax credit 2024: Senate vote and everything you need to know

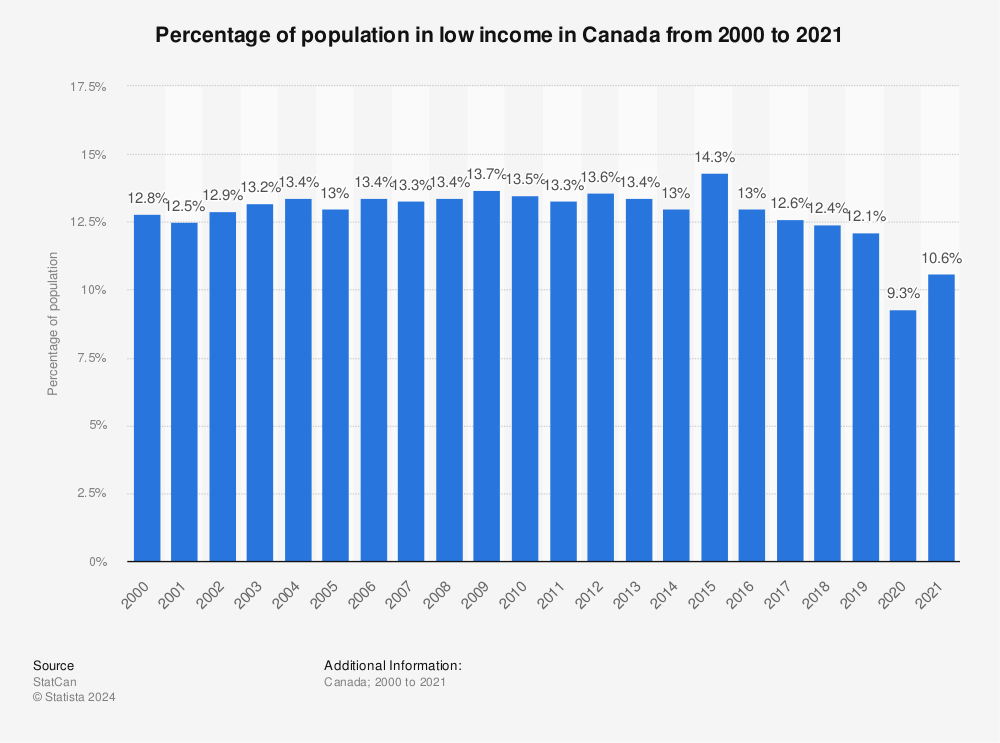

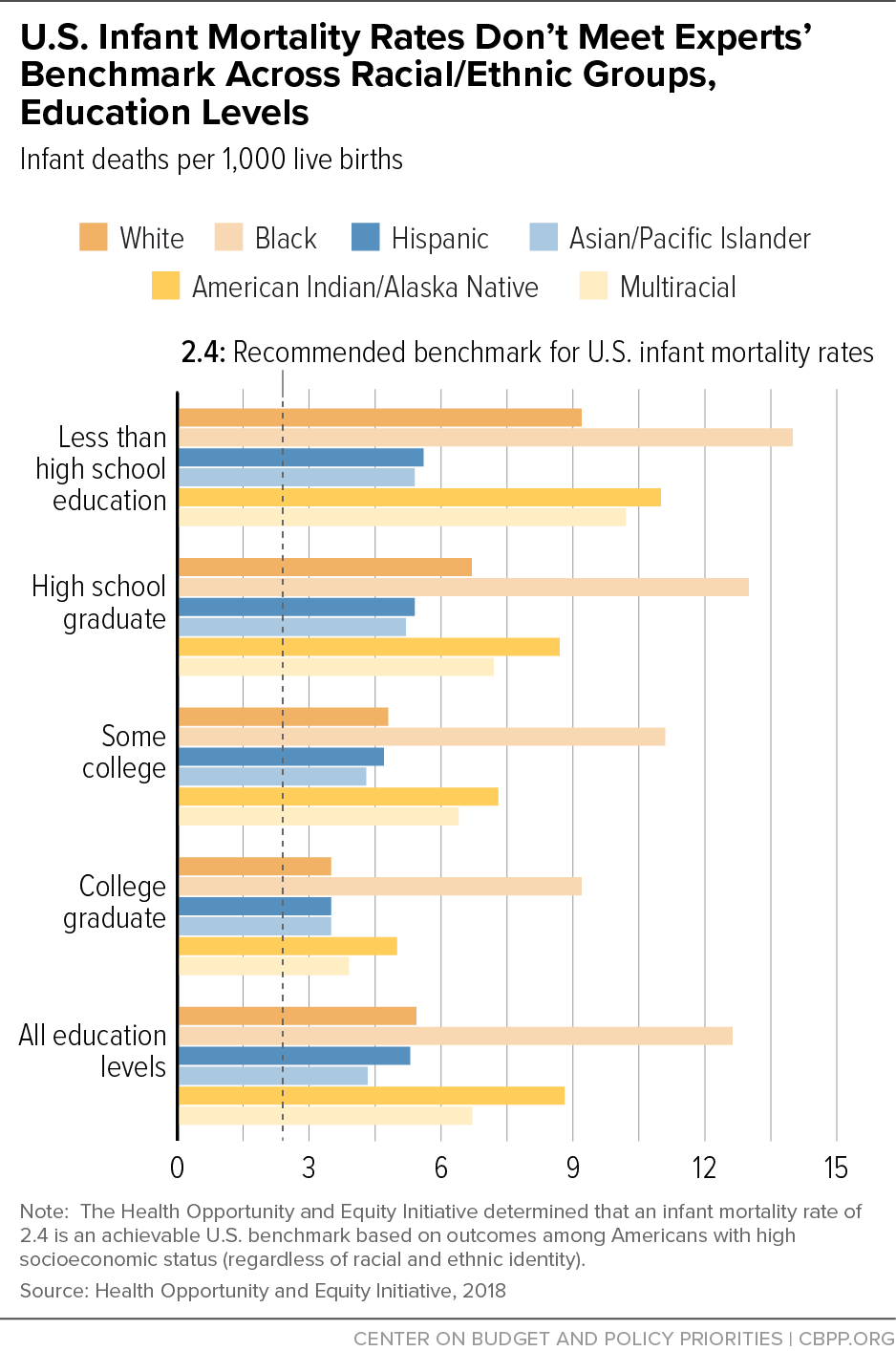

Better State Budget, Policy Decisions Can Improve Health

Better State Budget, Policy Decisions Can Improve Health

A D.C. Suburb Finds a Creative Answer to America's Housing

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)

Child Tax Credit Definition: How It Works and How to Claim It

More Housing Could Increase Affordability—But Only If You Build It in the Right Places Shelterforce

Investors Show Strong Interest In LIHTC Assets Fannie Mae, 46% OFF