:max_bytes(150000):strip_icc()/GettyImages-1175682245-6358c34288f249e88ef1ae4ffe74dc43.jpg)

How Will Getting Married Affect Your Premium Tax Credit?

4.6

(558)

Write Review

More

$ 12.00

In stock

Description

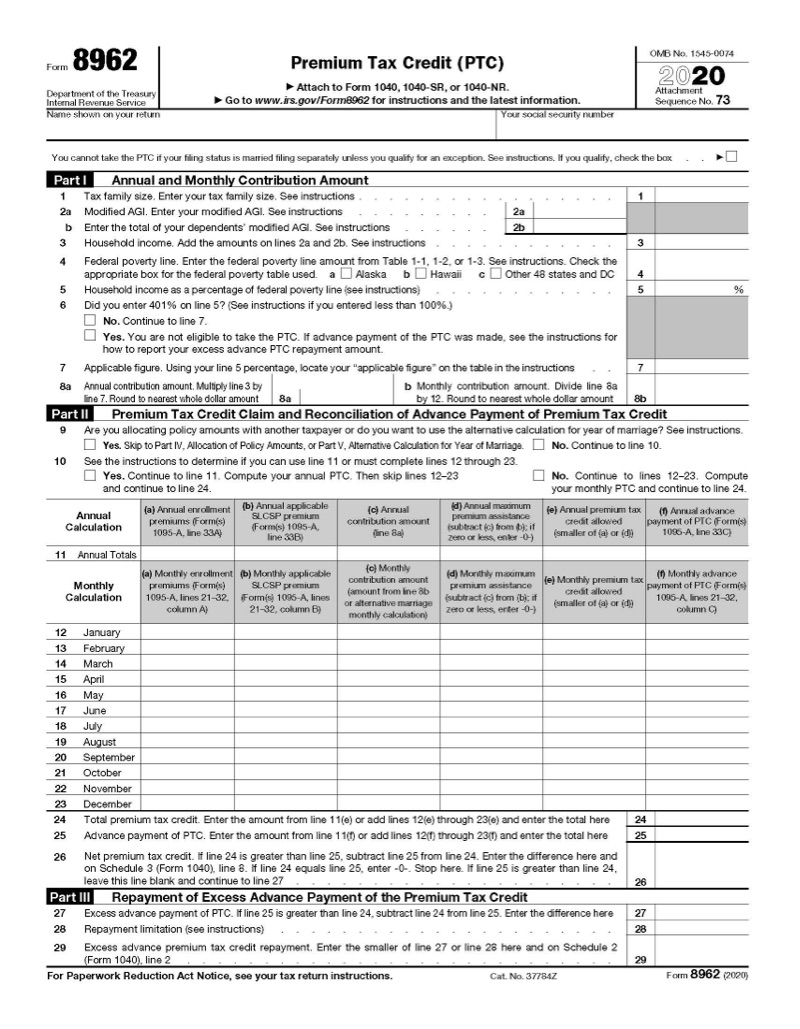

Premium tax credits are based on total household income, but the IRS has an alternative calculation you can use for the year you get married.

What is IRS Form 8962? Premium Tax Credit - Jackson Hewitt

What are the financial benefits of marriage?

Covered California Married Filing Separately: Medi-Cal filing separately

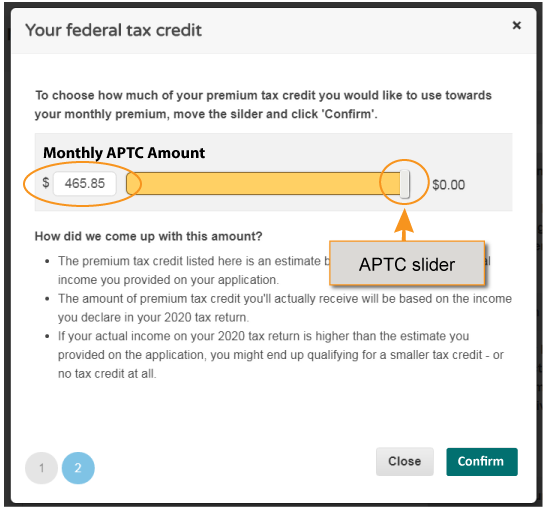

What Is the Advance Premium Tax Credit? - Experian

Adjust APTC Amount / MNsure

Chris Nester on LinkedIn: 2024 Outlook: Five Predictions in

:max_bytes(150000):strip_icc()/massachussetts-to-enact-mandatory-health-insurance-law-57319981-5c86d1b346e0fb00017b315a.jpg)

MAGI Calculation for Health Insurance Subsidy Eligibility

7 Tax Advantages of Getting Married - TurboTax Tax Tips & Videos

:max_bytes(150000):strip_icc()/GettyImages-480111441-586485f43df78ce2c3b1b8a7.jpg)

Should Married Couples Have Separate Health Insurance?

Are Two Incomes Better Than One for Married Taxpayers?

Taxes When Married vs. Single

Self-employed health insurance deduction

You may also like