In-Kind Donations Accounting and Reporting for Nonprofits

4.6

(412)

Write Review

More

$ 23.99

In stock

Description

Even though in-kind gifts are a major source of support for many nonprofits, recording and reporting them properly can present some unique challenges.

Cash & In-Kind Contributions

CFO Selections en LinkedIn: A Business Owner's Perspective on

Integrity in Finance – Why Establishing Trust Matters

Be “In-Kind”: Nonprofit accounting for donations of property and

A Guide to Nonprofit Accounting (for Non-Accountants) — Simply the

Best Practices in Nonprofit Cost Allocation Methodologies

Today's Top Nonprofit Leadership Challenges

Mastering the Budget Reforecasting Process

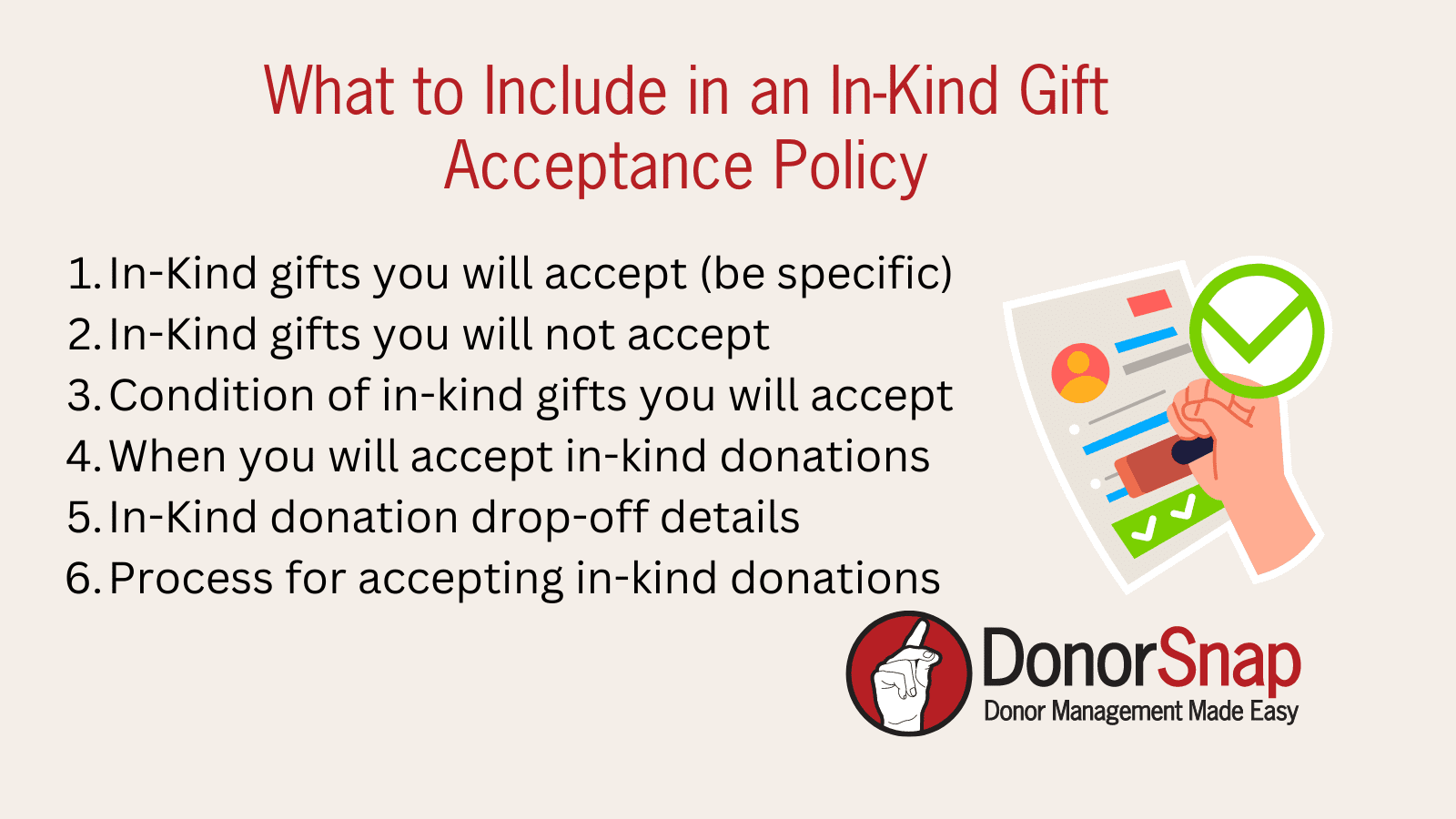

In-Kind Donations: A Complete Guide - DonorSnap

4 Ways Nonprofit Accounting Differs from For-Profit

Calculating Nonprofit ROI

Related products